nanny tax calculator virginia

This breaks down to 62 for Social Security and 145 for Medicare. If you have any additional questions we recommend contacting our Sales and Information team at 800-536-1099.

How To Pay Your Nanny S Taxes Yourself Nanny Tax Nanny Payroll Payroll Template

If youre unsure your Virginia household employer taxes warrant a payroll software check out our free demo.

. The user assumes all responsibility and liability for its use. A household employer is responsible to remit 765 of their workers gross wages in FICA taxes. Simply multiply your nannys gross wages by 765 to get your FICA tax responsibility.

Tax Calculator For Families of The Nanny Connection. Use Salary vs Overtime to. For example if your nanny grosses 800week then your FICA tax for that pay period.

This may mean youll need to file 1099-K forms with Virginia Tax that you would not need to otherwise submit to the IRS. Virginia State Payroll Taxes. The average total salary of Nannies in Virginia Beach VA is 31500year based on 12 tax returns from TurboTax customers who reported their occupation as nannies in Virginia Beach VA.

Based on 12 income tax records 17000. Our nanny tax calculator will help you to calculate nanny pay and determine your tax responsibility as a household employer whether paying a nanny a senior care worker or other household employees. Obtain an instant quote and purchase a policy online or contact our partner.

Since the top tax bracket begins at just 17000 in taxable income per. If you have any comments or questions about iFile please contact the Virginia Employment Commission at iFilevecvecvirginiagov or 804 786-1082 or the Virginia Department of Taxation at IFiletaxvirginiagov or 804367-8037. Were here to help.

Household workers can be your employees although there are some exceptions. Nanny salary in Virginia Beach VA. With simple pricing and low fees Savvy Nanny is a budget-smart choice whether you have one employee or a half dozen.

These policies pay for medical expenses and lost wages if an employee has a work-related injury or illness. Calculate domestic worker employee tax deductions. GTM Payroll Services provides this calculator as a means for obtaining an estimate of tax liabilities but should not be used as a replacement for formal calculations and does not constitute the provision of tax or legal advice.

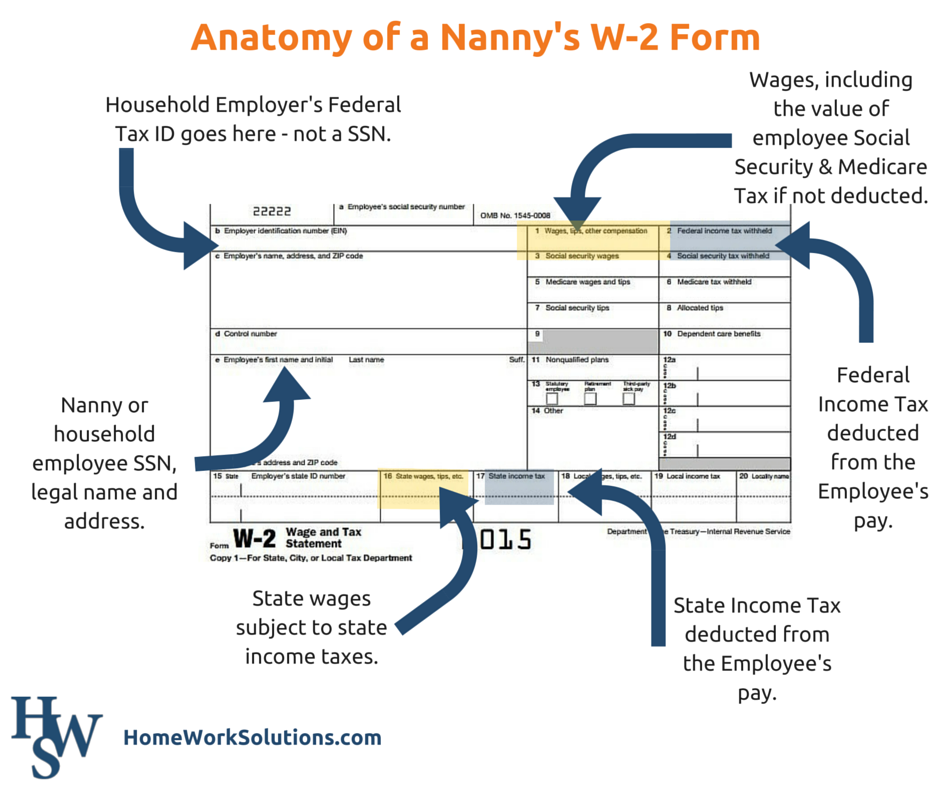

Your exact savings will depend on your household income. Copy A along with Form W-3 goes to the Social Security Administration. Easy-to-use nanny tax calculator provides estimate of tax responsibility for a householder employer and tax withholdings for nanny or other domestic worker.

Testimonial for The Nanny Tax Company from JB Virginia. And if you need a sample nanny contract or access to nanny tax forms before your nanny begins working we have these free. 33 Nanny Patch Cv Maggie Valley NC 28751.

Household employers in Virginia are not required to carry a workers compensation insurance however we advise all families to do so. Fill out Form W-2 if you pay wages of 1000 or more and give Copies B C and 2 to your nanny. Or if you need more help talking it through get a free phone consultation with one of our household experts.

Based on information submitted to the MLS GRID as of 2022-08-04 035441 PDT. If your business is a third-party settlement organization and paid 600 or more to a Virginia payee or to a payee at a Virginia mailing address you will also need to file a Form 1099-K for that payee with Virginia Tax. Tax rates range from 20 575.

These taxes can cost you about 10 over and above what youve agreed to pay for services. Virginia Extends Quarterly Nanny Tax Filing Deadline Posted by Vanessa Vidal on 11112 530 PM. If you pay your nanny cash wages of 1000 or more in a calendar quarter or 2400 in a calendar year file Schedule H.

2 bd 2 ba 16k sqft. Average salary 31500 yr. With four marginal tax brackets based upon taxable income payroll taxes in Virginia are progressive.

Gross vs Net Tax Calculator Employees Information Payment Frequency Weekly - 52 pay periods per year Bi-Weekly - 26 pay periods per year Semi-Monthly - 24 pay periods per year Monthly - 12 pay periods per year Annual - 1 pay period per year. Theyand youwill owe the government employment taxes often referred to as nanny taxes when the individual is classified as an employee according to tax rules. This is a great way to determine whether our tool is a good fit for your needs.

Use GrossNet to estimate your federal and state tax obligations for a household employee. December 3 2019 Google Fusion Tables and the Fusion Tables API have been discontinued. Whether you need help with Form R-1H or would.

Neighborhood stats provided by third party data sources. Now that you see what it may cost to hire a nanny what your taxes may be and how much you can save with tax breaks take a look at what our nanny tax and payroll service can do for you. Nanny tax calculator virginia Wednesday June 15 2022 Edit.

5 Answers You Need When Using A Nanny Tax Calculator

Nanny Tax Threshold For 2021 Sees Slight Increase Of 100

Virginia Household Employment Tax And Labor Law Guide Care Com Homepay

Nanny Taxes Q A Who Owes Who Pays H R Block Newsroom

Nanny Tax Payroll Calculator Gtm Payroll Services

I Never Got Around To Paying My 2016 Nanny Taxes Is It Too Late

W 4 Forms For Nannies And Caregivers Care Com Homepay

Nanny Tax Payroll Calculator Gtm Payroll Services

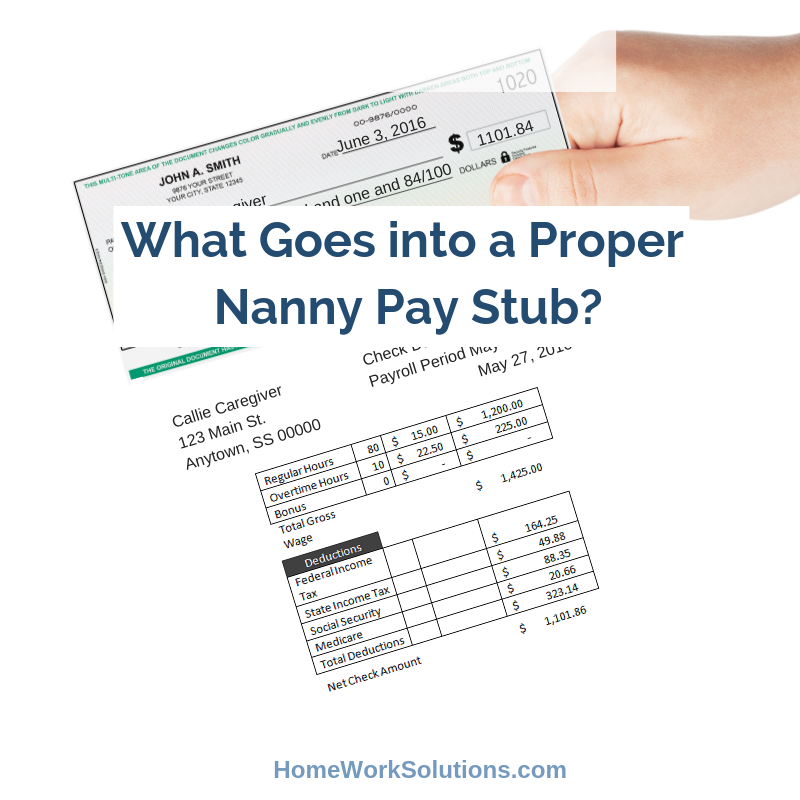

What Goes Into A Proper Nanny Pay Stub

Nanny Tax Calculator Gtm Payroll Services Inc

Virginia Nanny Tax Rules Poppins Payroll Poppins Payroll

Virginia Paycheck Calculator Adp

![]()

Virginia Nanny Tax Rules Poppins Payroll Poppins Payroll

Virginia Nanny Tax Rules Poppins Payroll Poppins Payroll

How To Calculate Your Nanny Taxes

Nanny Tax Calculators Nanny Payroll Calculators The Nanny Tax Company

The Right Time To Put A Nanny Or Caregiver On The Books Hws